https://youtube.com/watch?v=WJ_RITyiIEo%3Fautoplay%3D0%26mute%3D0%26controls%3D1%26origin%3Dhttps%253A%252F%252Fwww.abrwealthmanagement.com%26playsinline%3D1%26showinfo%3D0%26rel%3D0%26iv_load_policy%3D3%26modestbranding%3D1%26enablejsapi%3D1%26widgetid%3D1%26forigin%3Dhttps%253A%252F%252Fwww.abrwealthmanagement.com%252Fpost%252Fmaster-these-4-steps-to-create-a-christian-retirement-plan%26aoriginsup%3D0%26gporigin%3Dhttps%253A%252F%252Fwww.abrwealthmanagement.com%252Fblog%252Fpage%252F3%26vf%3D4

Today, we’re going to have a quick discussion on the four pillars of Christian investing. I get this question a lot: What’s the difference between Christian investing and traditional investing?

Well, let’s dive right in.

There’s not much difference except for one key element, which I’ll share with you at the very end. These four pillars form the foundation on which you’ll build your financial plan. The first is debt management.

Debt Management in Retirement

Without this first step, we will never be able to build a solid foundation for a Christian financial plan. Debt management is something we will continuously practice throughout our financial journeys, whether we’re in our twenties, thirties, forties, fifties, or sixties.

There’s always a chance that we’ll fall into debt or be faced with opportunities to take on more debt. This might look like purchasing a new car, buying a rental property, or dealing with an insurance claim after a major storm, such as a hurricane or tornado, where we don’t have the cash flow immediately available.

Understanding Debt and Interest Rates

We may have to take on debt or a loan. Being able to manage debt and understanding its components put us in a better situation. One of the first things we need to understand is the rate.

What are you being charged for this money?

Money has a cost.

Let’s make it simple.

If you have a credit card with a 20% interest rate and you buy a hamburger for $1, how much does that hamburger cost if you don’t pay it off until next year? It costs you $1.20 because of the interest.

Now, multiply this thinking over larger sums, like a $200,000 or $300,000 mortgage, with interest rates sometimes at six, seven, or eight percent.

Now you see why understanding interest rates is crucial.

Terms and Agreements

We also need to understand the terms by which we agree to repayment.

Are you paying back monthly?

Over 15 years? 30 years?

Terms vary with each type of loan. For credit cards, typically, they offer a 30-day grace period to pay back the loan before they begin charging interest on the remaining balances.

Retirement Savings

The True Meaning of Savings

Traditionally, when people think about savings, they imagine using coupons, catching sales, or seeing a suit marked down from $1,000 to $500.

But that’s not saving money.

Saving money means taking your purchasing power today and pushing it into the future to use if needed. However, many Americans are not pushing their purchasing power into the future but are instead spending tomorrow’s dollars today. This habit is destroying their financial plans.

Building a Safety Net

To build a robust financial foundation, we need to save. The general rule is to maintain at least six to nine months of emergency savings. This is vital in situations like a flat tire, changing jobs, needing first and last month’s rent for a new apartment, or dealing with a natural disaster.

“If you spend less than you make, you’ll always have money. The idea is simple: spend less than you earn, and this creates a gap – your savings.

Investing in Retirement

If you skip debt management and saving steps and jump straight into investing, the risks are high. With no savings and being in debt, losing even $1,000 in investments can be devastating. However, once you’ve managed your debt and saved sufficiently, you’re ready to multiply your wealth.

The Role of Charity in Christian Financial Planning

In Christian financial planning, charity plays a significant role. The first concern should always be your family. Ensure they have food, shelter, water, and other essentials. Anything extra can be dedicated to charity. Giving is important, but it should never jeopardize your family’s well-being.

“Anyone who does not provide for their relatives, and especially for their own household, has denied the faith and is worse than an unbeliever.” — 1 Timothy 5:8

Seeking Professional Guidance

When it comes to investing, you can consider retirement accounts like 401(k), 403(b), and 457 plans, as well as brokerage accounts. However, this is where a professional comes in handy.

DIY vs Professional Advisors

Yes, you can do it yourself, but do you want to spend 8 hours a day scrutinizing the stock market, analyzing index funds, stocks, and mutual funds?

Or would you rather consult with a professional who can provide you with the necessary information to make prudent decisions?

Wealth Transfer After Retirement

Wealth transfer is often overlooked in financial planning. Many Christians pass away without leaving instructions, which leads to their loved ones going through the same struggles they faced. It’s crucial to pass on our core beliefs and values to the next generation, just like the Bible has passed down its lessons.

The Importance of Documentation

To ensure your legacy, proper documentation is essential. This includes medical proxies and wills.

“Failing to plan is planning to fail.”

A medical proxy specifies who’s in charge and what actions to take in a medical emergency. A will ensures that your assets and wishes are honored and prevents disputes among your beneficiaries.

The Key Difference in Christian Investing

So what is the one key element that sets Christian investing apart from traditional investing?

God owns it all.

When we say God owns it all, it’s about our approach to financing. The stock market is volatile: it goes up and down, sometimes majorly. But we trust in God. This helps in maintaining a calm and centered approach to investing.

Control What You Can

We cannot control stock market fluctuations, weather events, or unforeseen circumstances. However, we can control our spending, savings, working duration, and charitable giving. Trust in God to handle what you cannot control and focus on managing what you can.

Conclusion

To recap, the four pillars of Christian investing are:

- Debt Management — Essential for building a solid financial foundation.

- Savings — Critical for ensuring financial security and emergency preparedness.

- Investing — Incorporates multiplying wealth and making informed decisions.

- Wealth Transfer — Ensures your legacy and beliefs are passed on to future generations.

Understanding these steps and leveraging professional advice ensure not just financial success but aligning your finances with your faith.

Remember, God owns it all. By trusting in Him, you manage your financial journey with grace and wisdom.

Ready to get started?

Explore more about Christian financial planning and connect with a professional advisor today!

Click Here To Start Planning For Your Retirement

Join our Newsletter and receive our free 19-page e-book “4 Financial Principles Every Christian Should Know”

Click Here To Get Your Free Gift

About Financial Advisors Say The Darndest Things Podcast:

As Christians, we were taught to be good stewards over our tithing and giving to the less fortunate. But when it came to our personal finances and investing we were left clueless on what the Bible says. What does the Bible say about managing debt, leaving a legacy, investing, and planning for your retirement? Mr. Christian Finance answers these and many other questions because we want to teach you how to become rich and righteous!

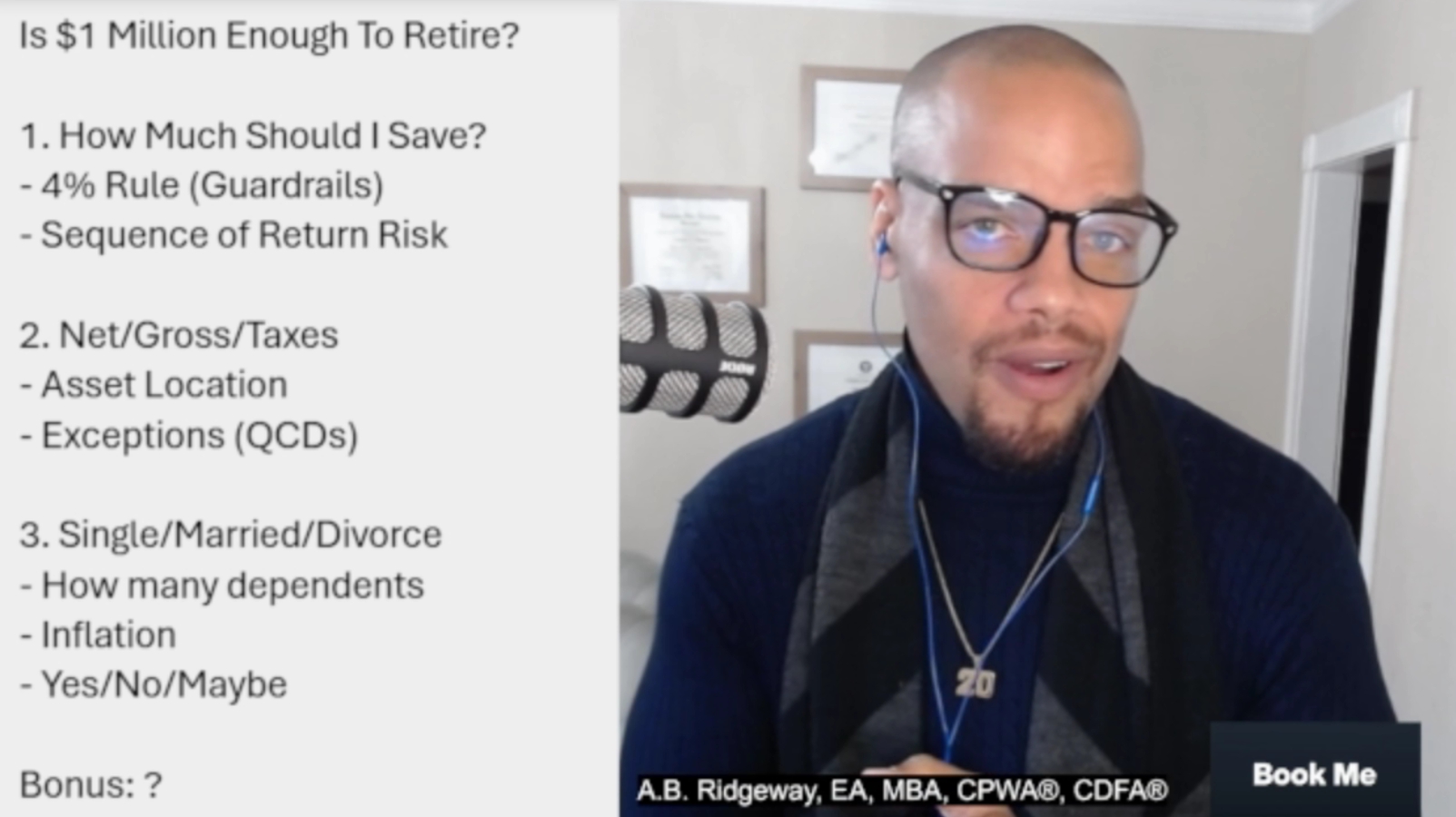

Meet A.B. Ridgeway:

A.B. Ridgeway, MBA, CPWA®️ (info@abrwealthmanagement.com) is the owner and Christian Financial Advisor with A.B. Ridgeway Wealth Management. With a decade in the finance industry, his goal is to give believers clarity around the most confusing topic in the Bible, money, and tithing. A.B. Ridgeway helps tithing Christians become cheerful givers but unlocking their money-making potential, so they can prosper and be the great stewards of the wealth God has entrusted them with.

*Disclaimer: This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. This is strictly for information purposes. We recommend you speak with a professional financial advisor.