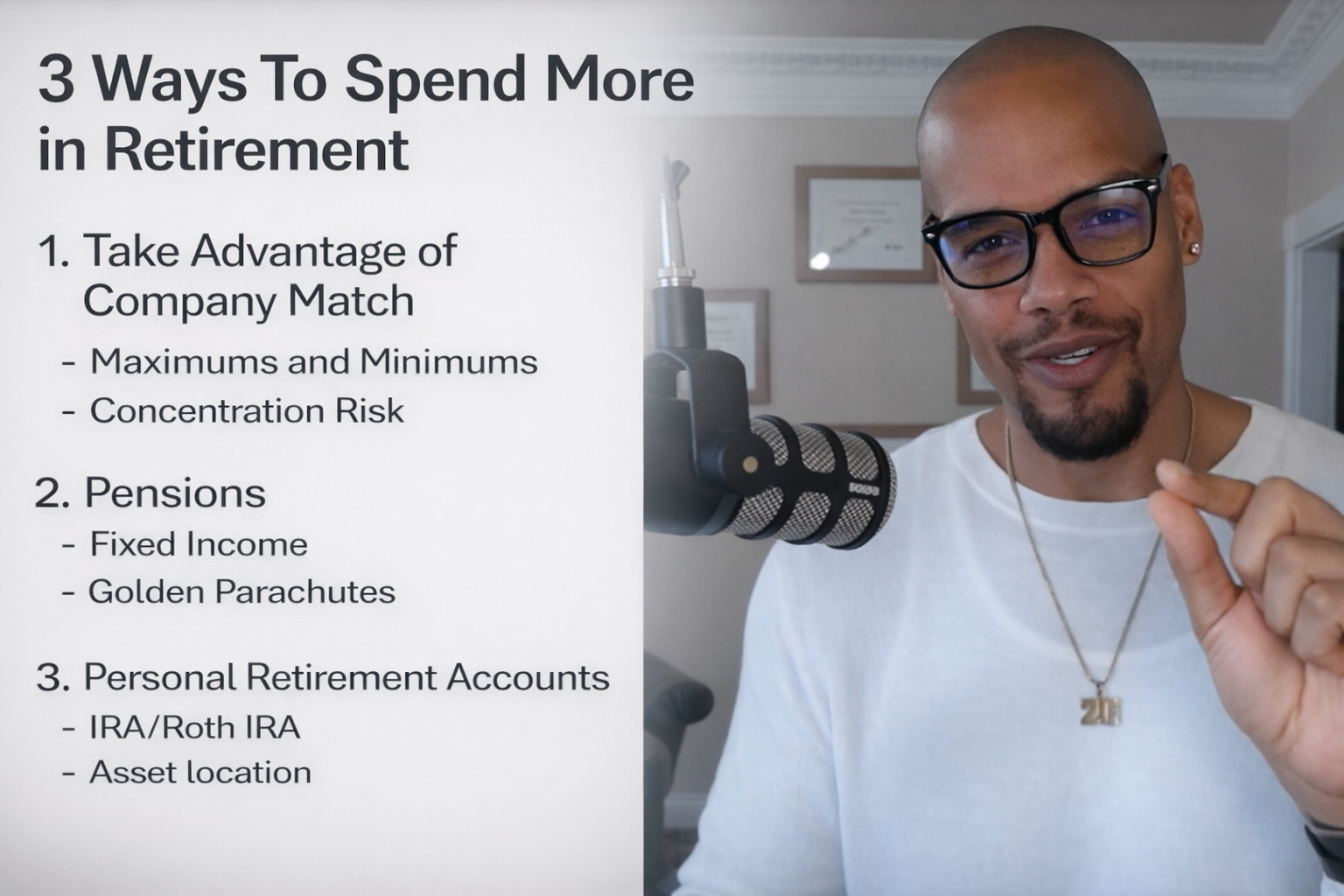

How to Create a Paycheck From Your Investments | Financial Advisor Explains

A.B. Ridgeway discusses the importance of calculating retirement income paycheck accurately to ensure financial stability. Using assumptions like inflation and rate of return, he demonstrates that one would need approximately $316,696.71 to withdraw $45,000 annually for eight years. Seeking expert financial advice is essential for effective retirement planning.